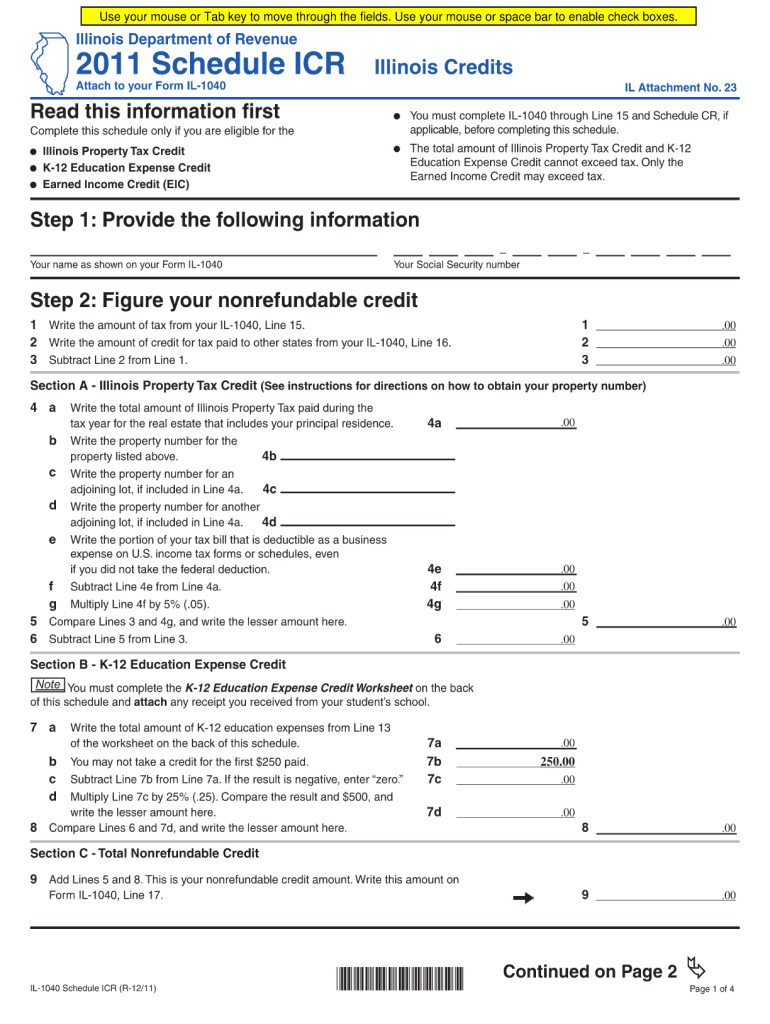

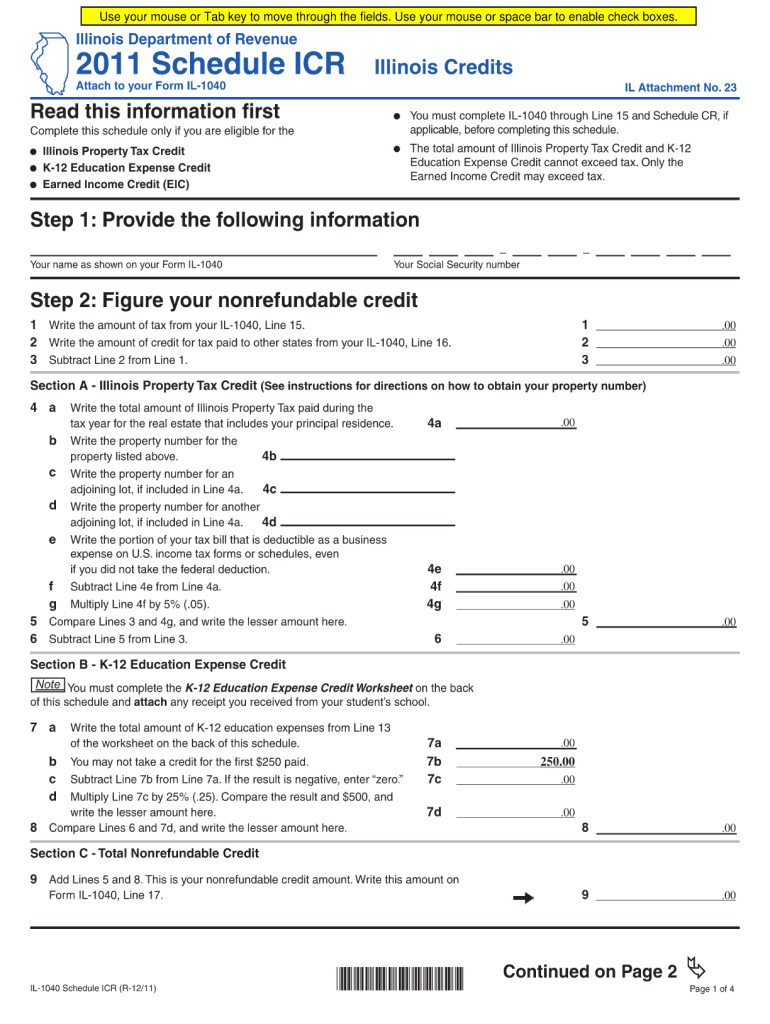

IL IL-1040 Schedule ICR free printable template

Get, Create, Make and Sign

Editing schedule icr illinois 2018 online

IL IL-1040 Schedule ICR Form Versions

Instructions and Help about schedule icr illinois 2018

Hi welcome to my channel in this presentation I want to go over important changes to form 1040 along with six new schedules and schedule another schedules like schedules b c d e and f haven't really changed also if you're self-employed I want to show you where to report your income expenses self-employment tax and quarterly estimated tax payments, but first I want to highlight the important changes made due to the tax reform here's a rundown of the new not quite postcard size to form 1040 and why it may not be as simple as it seems for many people the new 1040 will indeed make filing taxes simpler however for Americans with somewhat complicated tax situations this may not be the case despite the smaller size the new form 1040 is intended to replace not only the current form 1040 but also forms 1040 a and 1040 EZ all hundred 50 million taxpayers are expected to use the same form at least until the CGA a potentially expires at the end of 2025 in other words all 150 million taxpayers must use the same form regardless of their incomes or their personal financial situations now the plan is for taxpayers to only file the base form 1040 plus any new schedules that apply to their own facts or circumstances I will go over the new schedules in depth later the new form 1040 is now simplified with only 23 lines down from 79 and thanks to the tax cut and Jobs Act no one will be able to claim the following tax items for the next eight years and maybe even longer if Congress renews the terms of the CGA in 2025 they are the personal exemption miscellaneous deductions which were formally deductible if they exceeded two percent of your AGI the deduction for moving expenses unless you're a member of the Armed Forces and for divorces after December 31st 2018 the alimony payments are no longer deductible now let's look at the new form 1040 as you can see you still have five filing status now here at the top your standard deduction it used to be on page two same for your spouse health care coverage exemption checkbox is on page one used to be on page two some lawmakers have touted the disappearance of the share responsibility payment the law was still in effect for 2018 you must make a shared responsibility payment if for any month in 2018 you your spouse if filing jointly or anyone you claim as a dependent didn't have coverage and doesn't qualify for a coverage exemption in here you will sign the return on the front page now instead of the second page now let's go to the second page notice lines 1 through 7 that's where we report our income I will show you later how we report self-employment income line number nine is a qualified business income deduction as known as section 199 cap a 20 deduction that all the business owners are excited about in my next presentation I'll be discussing in depth on this FBI deduction plus to some sample calculations so if you're a business owner and or a landlord I invite you to watch the presentation so in a nutshell the front...

Fill form : Try Risk Free

People Also Ask about schedule icr illinois 2018

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your schedule icr illinois 2018 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.